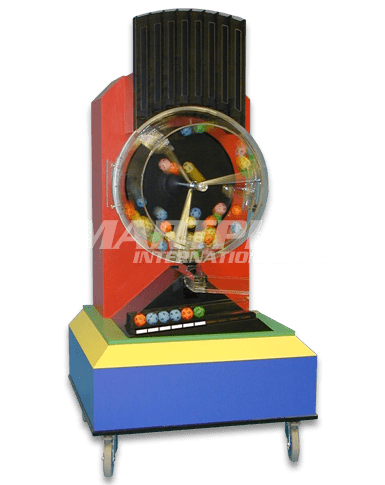

Bingo Draw Machine

Many California nonprofit corporations receive a significant amount of income from various types of gaming, such as bingo, poker tournaments, and raffles. Both state and federal laws govern these activities, prohibit certain forms of gaming and mandate registration and reporting. Each state has different rules on gaming. This brief overview looks at California laws governing these activities as well as touching on federal tax implications. It does not discuss auctions which are not considered gaming under California law.

BINGO

Under section 326.5 of the California Penal Code, certain California nonprofits are eligible to conduct bingo games if permitted under a local city and/or county ordinance. The authorizing ordinance must be enacted under section 19 of Articles IV of the California Constitution. Such ordinances generally can be found in the local municipal code, the content of which may be available online or through local government officials.

The bingo game must be conducted consistent with the California Penal Code and the authorizing ordinance. Under the Penal Code, the following requirements apply:

The Video Raffle is Australia's premium raffle drawing package. The easy to use operator interface connects to most forms of audio visual equipment. Single or multiple number draw functionality. Use up to 3 separate 7 digit number ranges in one raffle draw. Optional on screen draw history. Love it or hate it, gambling is here to stay. And despite unprecedented declines in revenue due to COVID-19 lockdowns, the industry is likely to make a phenomenal comeback as online converts flock back to real-life locations for in-the-flesh contact after months of being glued to their screens. Pre-COVID, the numbers were already astonishing. In Great Britain, the reported gross gambling yield.

RUNNING A BINGO, POKER, OR RAFFLE CHARITY FUNDRAISER IN CALIFORNIA. Many California nonprofit corporations receive a significant amount of income from various types of gaming, such as bingo, poker tournaments, and raffles. Both state and federal laws govern these activities, prohibit certain forms of gaming and mandate registration and reporting. This is like an audio-enabled bingo cage in your pocket. This app is a replacement for your bingo cages. Play Bingo/Tambola/Housie anywhere, anytime with a small group of friends or play in a big party with many people. You can even use this Bingo Number Generator app in places where it is not possible to use a bingo cage at all, like while traveling with a group of friends in a bus.

What organizations are eligible: Organizations eligible to conduct bingo include those exempt from taxation under California’s Revenue and Taxation Code Sections 23701a, b, d, e, f,g, k, l, and w and mobile home park associations, senior citizens organizations, and charitable organizations affiliated with a school district.

Registration Requirements: Local cities and/or counties usually require registration or application for a permit prior to conduct of the game. An example of an authorizing ordinance from my hometown of Alameda is here.

Who can participate: Minors under 18 years old may not participate in the bingo game and the game must be open to the public. Participants must be physically present at the time and place where the bingo game is conducted.

Who can operate the game: The game must be operated and staffed only by members of the nonprofit organizing it. Neither those members nor any other person may receive a profit, wage, or salary from the game with the exception of security personnel.

Where the game can take place: The nonprofit must conduct the game on property either owned or leased by it, or the use of which is donated to it, and that property must be used by the nonprofit as an office or for the performance of its tax exempt purposes.

What can be included as prizes: The total value of prizes cannot exceed five hundred dollars in cash or kind for each game. Local laws may reduce this amount.

How proceeds from the game can be used: For 501(c)(3) charities, all profits from the game must be kept in a segregated account and used only for charitable purposes. For other eligible nonprofit organizations, all proceeds of the game must be used for charitable purposes with minor exceptions as outlined in California law.

Local bingo ordinances often have further detailed requirements, including length and number of permissible events, and require registration and/or a permit prior to conducting the game.

POKER

Under Article 17 of the California Business and Professions Code, qualified California nonprofit organizations may engage in “charity poker nights” with games such as poker and Pai Gow subject to the following restrictions:

What organizations are eligible: Organizations must be qualified to conduct business in California for at least three years prior to holding the poker night and must be exempt from taxation under one of the following sections of the Revenue and Taxation Code: 23701a, b, d, e, f, g, k, l or w.

Registration requirements: Eligible organizations must register annually with the Bureau of Gambling Control. Registration forms are here and must be accompanied by a $100 non-refundable registration fee. In addition, local ordinances may impose additional registration and other requirements.

How often/how long: Each nonprofit or chapter can hold a maximum of one poker fundraiser per calendar year. Each fundraiser can last a maximum of five consecutive hours and no more.

Who can participate: Participants must be 21 years or older.

What can be included as prizes: Cash prizes are prohibited. All prizes must be donated. Individual prizes cannot exceed a cash value of five hundred dollars and the total cash value of all prizes cannot exceed five thousand dollars per event.

How proceeds from the game can be used: At least ninety percent of the gross revenue from the fundraiser must go directly to a nonprofit organization; no more than ten percent can be paid as compensation to anyone conducting the fundraiser (exclusive of any facility rental costs).

What records must be kept: The nonprofit must retain records of the fundraiser, including (1) itemized list of gross receipts, (2) itemized list of recipients of the fundraiser’s net profits, (3) number of persons participating, (4) itemized list of direct costs incurred, (5) list of all prizes awarded and (6) date, hours, and location of each fundraiser.

RAFFLES

California Penal Code section 320.5 prohibits raffles unless conducted by an eligible organization in compliance with applicable laws and regulations.

What is a raffle: In California, a raffle is a scheme (1) for the distribution of prizes, (2) by chance, (3) among persons who have paid money for paper tickets, and (4) the paper tickets provide the opportunity to win these prizes.

A raffle is exempt from registration with the Attorney General’s Office if all of the following are true: (1) It involves a general and indiscriminate distribution of the tickets; (2) tickets are offered on the same terms and conditions as tickets for which a donation is given; and (3) the scheme does not require any of the participants to pay for a chance to win.

What entities are eligible: Organizations must be nonprofits qualified to conduct business in California for at least one year prior to conducting the raffle and exempt from taxation under Revenue and Taxation Code Section 23701a, b, d, e, f, g, k, l, t or w.

Registration Requirements: Eligible organizations must register annually with the Registry of Charitable Trusts, California Department of Justice. Registration forms are here and must be accompanied by a $20 registration fee.

How the raffle must be conducted: The paper raffle tickets must be sold with a detachable stub or coupon, and have a unique matching identifier on both the ticket and the stub. The draw must determine the winner of the prize from among the detached stubs. It must be conducted under supervision of a natural person 18 years or older. It cannot be conducted by gaming machine.

How proceeds from the raffle can be used: At least ninety percent of the gross receipts from the sale of raffle tickets must be used to support a beneficial or charitable purpose or another nonprofit organization that performs beneficial or charitable purposes.

Restrictions on online raffles: The raffle may not be operated over the Internet and raffle tickets cannot be sold, traded, or redeemed over the Internet. However, the organization can advertise the raffle on the Internet if the information includes: (1) lists, descriptions, photographs or videos of raffle prizes, (2) lists of the prize winners, (3) rules of the raffle, (4) Frequently Asked Questions, (5) raffle entry forms (that can be manually downloaded and sent or submitted to the organization NOT through the Internet), and (6) raffle contact information.

Raffle reporting: Nonprofits must prepare and submit a Nonprofit Raffle Report (located here) after all raffle events for the registration year have occurred. The nonprofit must also retain records of the following: date and location of raffle, total funds received from each raffle, total expenses for conducting each raffle, charitable or beneficial purpose for which the raffle proceeds were used or the amount and organization to which proceeds were directed.

Bingo Draw Machine Online

FEDERAL TAX

Even if a nonprofit’s charitable gaming is in compliance and with California and local laws, it may still need to consider the effect on its tax-exempt status. In particular, it should review its gaming practices under:

Qualification for Tax Exemption: Gaming is a business and recreational activity; it is not charitable in nature nor does it promote social welfare. For charities, social welfare organizations, and labor, agricultural or business leagues, gaming should be limited to an insubstantial part of the organization’s activities. For other relevant organizations, including social clubs, fraternal organizations and veterans’ organizations, gaming activities must be evaluated within the context of the applicable tax rules to avoid jeopardization of exempt status.

Unrelated Business Income Tax: Exempt organizations pay tax on unrelated business income (UBI). Activities may generate UBI if they are a trade or business (such as gaming), regularly carried on (for example, every week), and not substantially related to the organization’s exempt purpose. There are a number of exceptions to UBI such as for qualified bingo games and activities conducted with substantially all volunteer labor that may apply in the context of charitable gaming and should be reviewed.

In addition there may be other tax and reporting requirements that apply. The IRS publication 3079 on Charitable Gaming provides a good overview for use by exempt organizations and their advisors on the tax laws governing gaming activities.

WRITTEN BY: CAMERON HOLLAND

Table of Contents

GeneralWhat is a remote caller bingo game?

I have a complaint regarding the operation of a bingo game. Where can I file a complaint?

City or County Approval

If a city or county wishes to authorize remote caller bingo games in its jurisdiction, what must the local ordinance include?

Organization Eligibility to Conduct Remote Caller Bingo

Which nonprofit organizations are eligible to conduct remote caller bingo?

Our organization is eligible to conduct remote caller bingo. How does our organization become authorized by the California Gambling Control Commission to conduct remote caller bingo games?

Remote Caller Bingo Licenses and Permits

Who is required to be issued licenses and permits by the Commission in order to participate in the operation of remote caller bingo games?

How do I become licensed by the Commission to conduct remote caller bingo?

General

What is a remote caller bingo game?

A remote caller bingo game means a game of bingo in which the numbers or symbols on randomly drawn plastic balls are announced by a natural person present at the site at which the live game is conducted. The organization conducting the bingo game uses audio and video technology to link any of its in-state facilities for the purpose of transmitting the remote calling of a live bingo game from a single location to multiple locations. The locations must be owned, leased, or rented by that organization, or the use of which has been donated to the organization.

I have a complaint regarding the operation of a bingo game. Where can I file a complaint?

Complaints regarding the conduct of remote caller bingo games should be submitted to the Department of Justice, Bureau of Gambling Control (Bureau). The Bureau may be contacted as follows:

Bureau of Gambling Control

P.O. Box 168024

Sacramento, CA 95816-8024

Phone: (916) 227-3584 – Fax: (916) 227-2342

Email: GamblingControl@doj.ca.gov

Complaints regarding the conduct of bingo games that are not remote caller bingo games should be submitted to the local city or county government offices that oversee bingo. This may be the police department, sheriff's office, or business permit office.

City or County Approval

If a city or county wishes to authorize remote caller bingo games in its jurisdiction, what must the local ordinance include? The local ordinance must require remote caller bingo games to be conducted in accordance with the provisions of Penal Code Section 326.3,including the following requirements:

- The game may be conducted only by the following organizations:

- An organization that is exempted from the payment of the taxes imposed under the Corporation tax Law by Section 23701a, 23701b, 23701d, 23701e, 23701f, 23701g, 23701k, 23701l, or 23701w of the Revenue and Taxation (R&T) Code.

- A mobilehome park association.

- A senior citizens' organization.

- Charitable organizations affiliated with a school district.

- The organization conducting the game shall have been incorporated or in existence for three years or more.

- The organization conducting the game shall be licensed pursuant to subdivision (l) of Section 326.5.

- The receipts of the game shall be used only for charitable purposes. The organization conducting the game shall determine the disbursement of the net receipts of the game.

- The operation of bingo may not be the primary purpose for which the organization is formed.

Organization Eligibility to Conduct Remote Caller Bingo

Which nonprofit organizations are eligible to conduct remote caller bingo?

In order to be eligible to conduct remote caller bingo nonprofit organizations must meet the requirements described in Penal Code Section 326.3(b)(1), which should be reviewed for specific information. The following is a partial summary of these legal provisions:

- a mobilehome park association

- a senior citizens' organization

- a charitable organization affiliated with a school district

- An organization that is exempted from the payment of the taxes imposed under the Corporation Tax Law by the Revenue and Taxation (R&T) Code:

- a labor, agricultural or horticultural organization (R&T Code sec. 23701a)

- a fraternal order (R&T Code sec. 23701b)

- a corporation, community chest or trust, organized and operated exclusively for religious, charitable, scientific, testing for public safety, literary, or educations purposes, or to foster national or international amateur sports competition, etc. (R&T Code sec. 23701d)

- a business league, chamber of commerce, real estate board, or board of trade (R&T Code sec. 23701e)

- a civic league, social welfare organization, or local organization of employees (R&T Code sec. 23701f)

- a social organization (R&T Code sec. 23701g)

- religious or apostolic corporations (R&T Code sec. 23701k)

- a domestic fraternal society (R&T Code sec. 23701l)

- a veterans organization (R&T Code 23701w)

- The organization must have been in existence for three years or more;

- The organization must be licensed by the local jurisdiction (city or county);

- Receipts of the game must be used only for charitable purposes; and

- Operation of bingo may not be the primary purpose for which the organization is formed.

Our organization is eligible to conduct remote caller bingo. How does our organization become authorized by the California Gambling Control Commission to conduct remote caller bingo games?

In order for the California Gambling Control Commission (Commission) to authorize an organization as to conduct remote caller bingo, the highest ranking officer of the organization must submit a Statement of Eligibility to Conduct Remote Caller Bingo, BGC-618, to the Bureau of Gambling Control (Bureau). The Bureau will review the statement and, if complete, will forward it to the Commission to be scheduled for consideration at a noticed meeting.

Remote Caller Bingo Licenses and Permits

Who is required to be issued licenses and permits by the Commission in order to participate in the operation of remote caller bingo games?

Individuals that will perform duties in the capacity of a fiduciary or caller, are required to have a valid license issued by the Commission. Any administrative, managerial, technical, financial, and security personnel must obtain valid work permits issued by the Commission. For further information, please review the Remote Caller Bingo Regulations link on the Remote Caller Bingo web page.

How do I become licensed by the Commission to conduct remote caller bingo?

The Commission has established an interim license and interim work permit process to expedite the implementation of remote caller bingo. Applicants will be subject to a criminal history review to determine suitability for an interim license or work permit. Once the review is complete consideration for approval will be set at a noticed Commission meeting

An Application for Interim License for Remote Caller Bingo, BGC-620, must be submitted to the Bureau for individuals with the following responsibilities for remote caller bingo games:

Bingo Draw Numbers

- Fiduciary

- Caller

An Application for Interim Work Permit for Remote Caller Bingo, BGC-622, must be submitted to the Bureau for anyone employed by the organization that is responsible for the performance of duties in any of the following categories:

Electronic Bingo Machines For Sale

- Administrative

- Managerial

- Technical

- Financial

- Security

Air Bingo Machine

An Application for Interim License for Bingo Equipment Manufacturers and Distributors, BGC-610, must be submitted to the Bureau for owners with a 10 percent or greater ownership interest in a business that manufactures or distributes card-minding devices, or other bingo supplies, equipment, or services used in the playing of remote caller bingo.